Don't Miss

Most Read

Trending on GB News

Rishi Sunak’s decision to reintroduce the state pension triple lock has proved divisive, as nearly half of those asked think the UK can’t afford the measure amid the cost-of-living crisis.

The Chancellor confirmed the triple lock will be reinstituted in April 2023 and that the rise will be in line with the inflation rate, which “will be whatever the estimated CPI (Consumer Price Index) is in September".

The current estimated rate of inflation is expected to be around 7.4 percent.

The move aims to help pensioners battle soaring energy bills and fuel prices, exacerbated by the pandemic and Ukraine-Russia war, by increasing their purchasing power.

But in the face of such economic uncertainty, concerns have emerged as to whether such a significant increase is feasible.

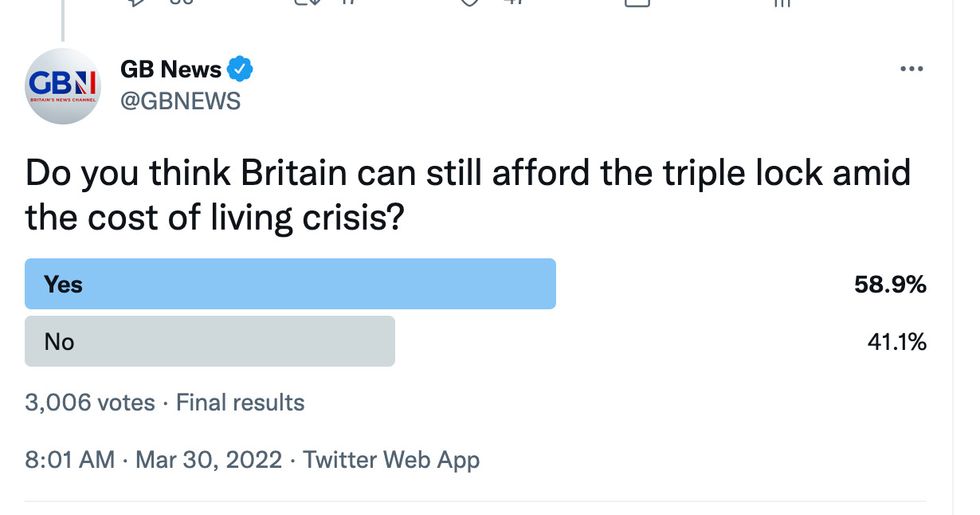

A new poll posted on Twitter by GB News showed 58.9 percent agreeing that the UK can afford the triple lock, while, 41.1 percent of the 3,006 voters think Britain can’t afford it amid the cost-of-living crisis.

GB News poll conducted on Twitter

@GBNEWS/Twitter

The triple lock guarantees that pensions grow in line with whichever is highest out of earnings, inflation or 2.5 percent, but the earnings element was temporarily suspended for 2022/23 due to the distorting impact of the coronavirus crisis on wages.

Mr Sunak had faced widespread criticism after suspending the formula for this year because the surge in earnings, as the economy reopened after the lockdown, would have forced a pensions rise of about eight percent.

Tory MP Harriett Baldwin asked the Chancellor: "For pensioners this year, you're guaranteeing the triple lock again?"

Mr Sunak replied: "Yes."

Chancellor of the Exchequer Rishi Sunak

UK PARLIAMENT/JESSICA TAYLOR

Asked what the Treasury was budgeting for the pension rise, he added: "It will be whatever the estimated Consumer Price Index is in September - seven-ish percent."

The move comes as nearly two-thirds (66 percent) of people starting their retirement this year do not expect to give up work completely as living costs surge, according to new a survey.

This compares with just over half (56 percent) of those who retired last year and a third (34 percent) who retired in 2020, investments and wealth management company abrdn found.

The report surveyed 2,000 people across the UK who have either recently retired or are about to.

At the Treasury Committee, Mr Sunak defended his recent Spring Statement following widespread criticism that it did not do enough for low income families and pensioners in the face of the looming cost-of-living crisis.

He said: "We are already forecast to borrow in this coming year about 60 percent, more as a percentage of GDP than our post-war average, 20 percent more as a percentage of GDP than we were forecast to borrow in October, so it is already a significant amount of borrowing.

"My view is an excessive amount of borrowing now is not the responsible thing to do."

Mr Sunak defended the choices he had made in last week's statement.

Conservative MP Mel Stride, the committee chairman, said the Chancellor had done "very little" for those who were out of work and relying on benefits.

Mr Sunak said: "If someone's view is Government can or should make everybody whole for inflation - particularly inflation at these levels caused by global supply factors - then that's something that I don't think is do-able."