Don't Miss

Most Read

Trending on GB News

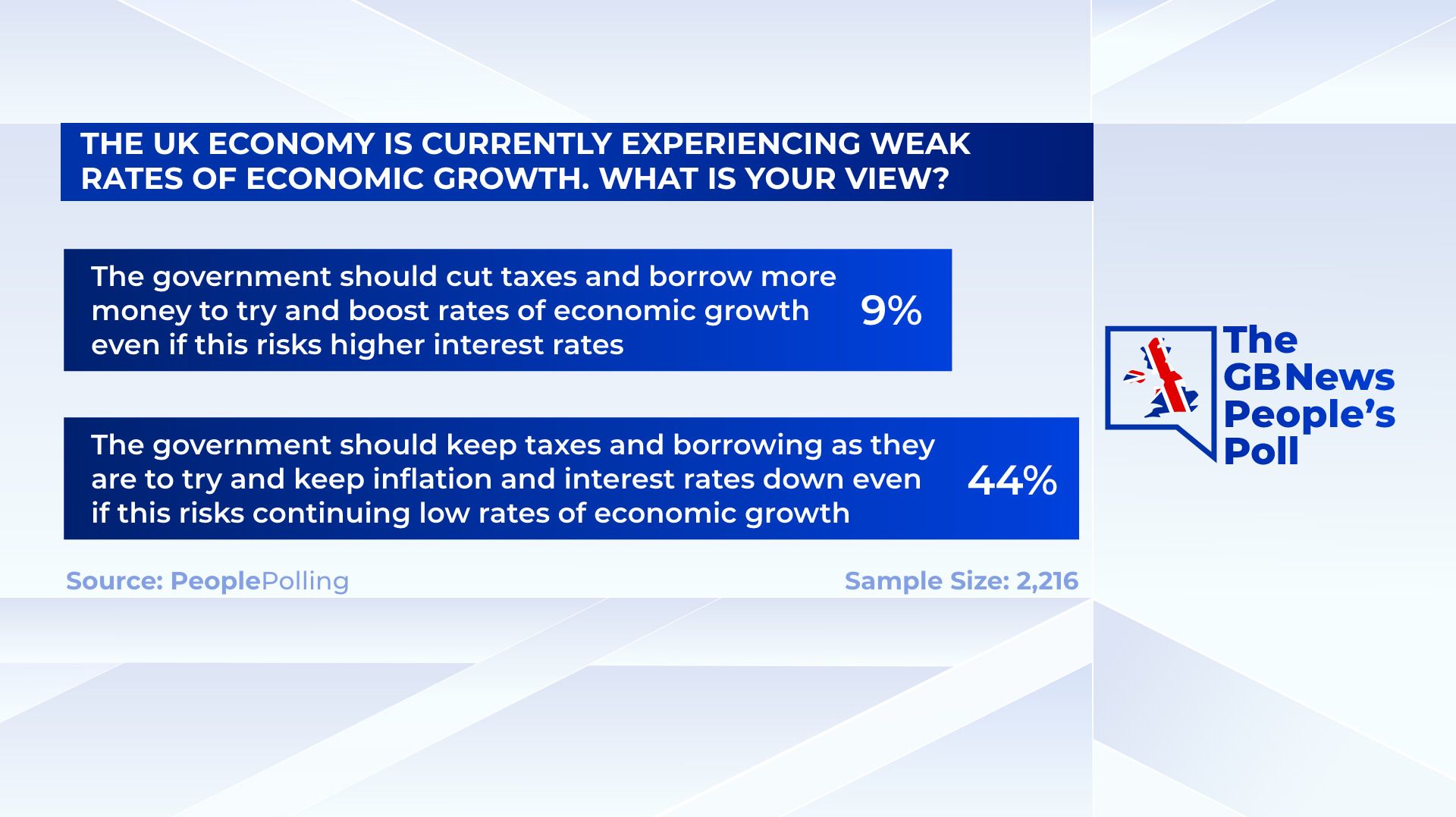

Prime Minister Liz Truss has seen chaos in the financial markets amid fears of rocketing mortgage bills sparked by Chancellor Kwasi Kwarteng’s mini-budget last week.

And GB News viewers have piled more pressure onto the embattled PM.

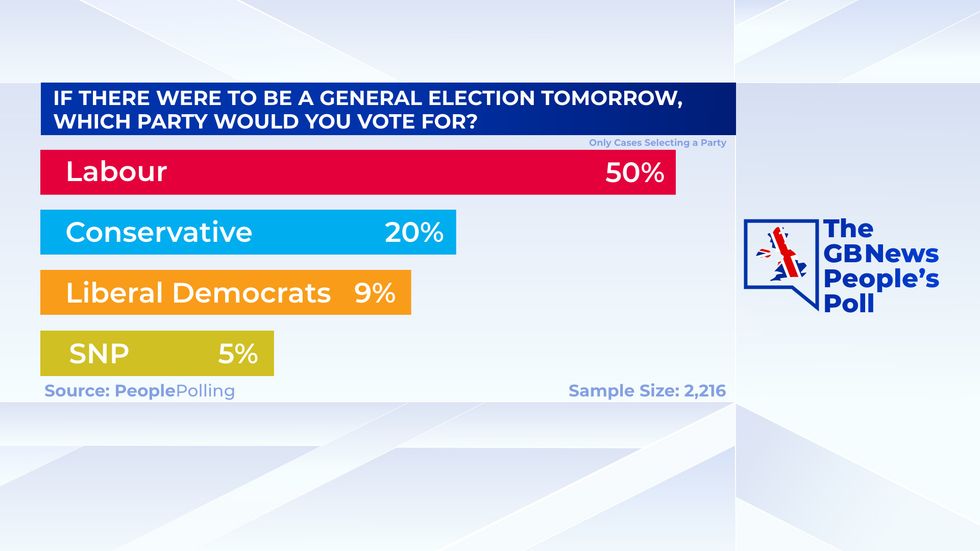

Results from the People's Poll of 2,216 give the Labour Party a 30-point lead over Ms Truss' Conservative Party.

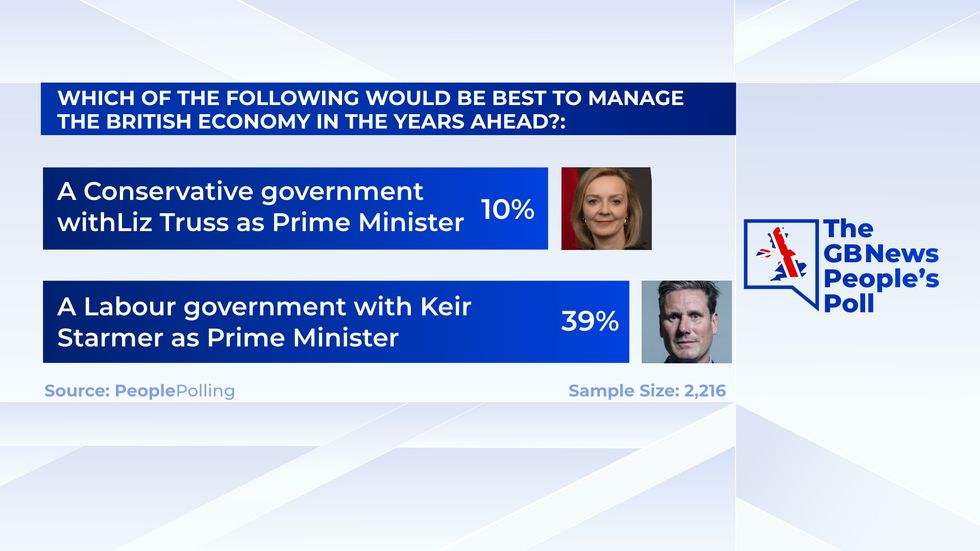

Viewers made it clear they prefer the idea of Sir Keir Starmer managing the economy.

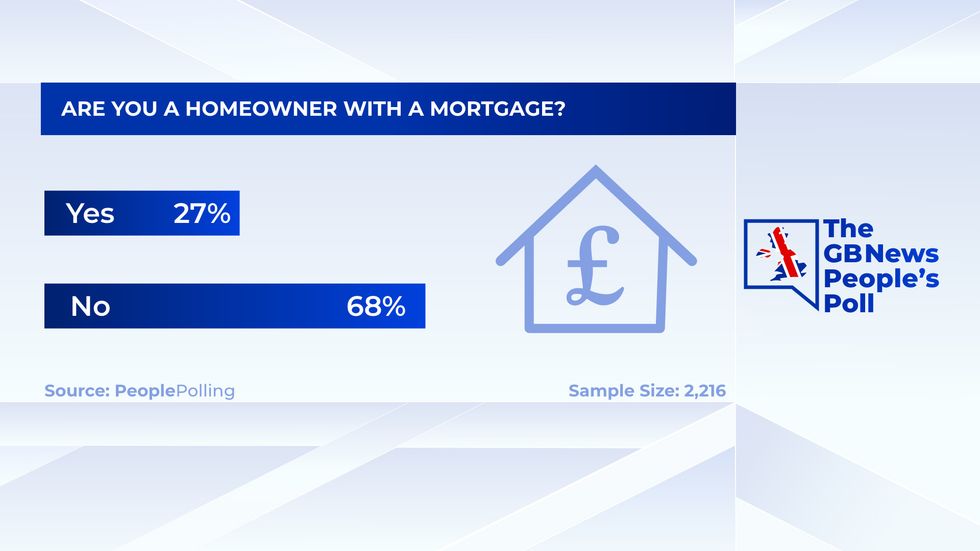

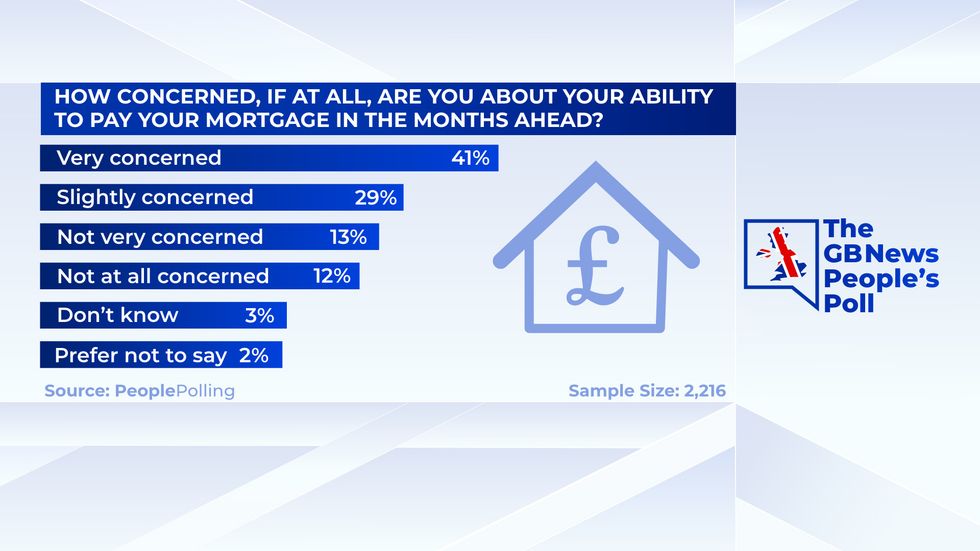

Referring to the months ahead, 41 percent of homeowners said they are concerned about their ability to pay their mortgage.

Prime Minister Liz Truss

Maja Smiejkowska

The People's Poll

GB News

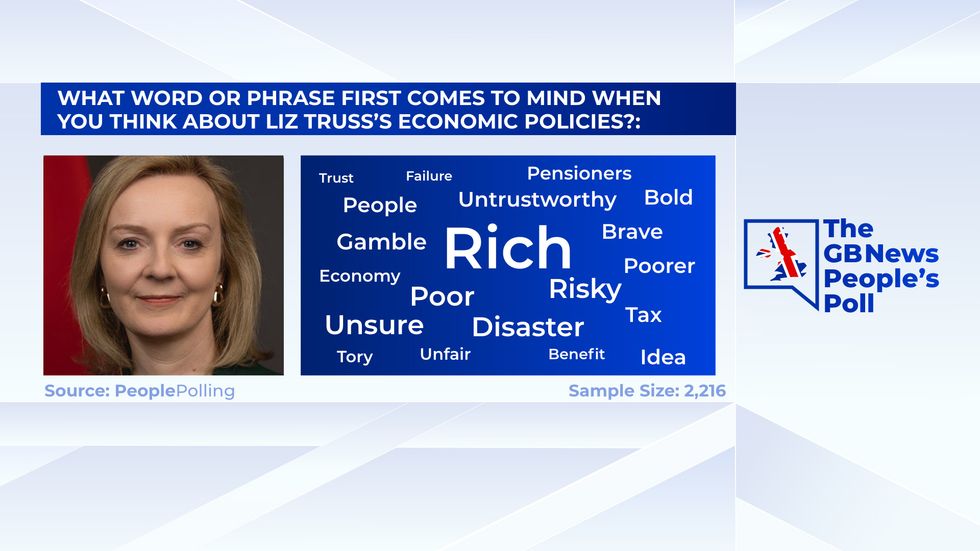

And when people are asked about Ms Truss’ economic policies, the words that come to mind are "rubbish" and "disaster".

It comes after the Bank of England launched an emergency Government bond-buying programme on Wednesday to prevent borrowing costs from spiralling out of control and stave off a “material risk to UK financial stability”.

It brought up to £65billion worth of Government bonds – known as gilts – at an “urgent pace” after fears over the Government’s tax-cutting plans sent the pound tumbling and sparked a sell-off in the gilts market, which left some UK pension funds teetering on the brink of collapse.

On Thursday, the pound regained some ground, rising to above 1.1 dollars for the first time since last Friday.

But the FTSE 100 dropped around two percent to 6,864 – its lowest point since March this year, amid a global sell-off, while yields on the UK’s 10-year gilts were up to 4.14 percent.

Speaking in Northern Ireland, the Bank’s chief economist, Huw Pill, underlined warnings that they would have to sharply raise interest rates, noting that there was “undoubtedly a UK-specific component” to recent market movements.

His comments contrasted with Ms Truss, who blamed “Vladimir Putin’s war in Ukraine” for pushing up global energy prices.

For Labour, Shadow Chancellor Rachel Reeves called on Ms Truss and Mr Kwarteng to reverse their “kamikaze budget”.

Earlier, trade unions called for a “cast-iron guarantee” that there would be no more cuts to public spending after Treasury Chief Secretary Chris Philp confirmed Whitehall departments had been instructed to carry out an “efficiency and prioritisation exercise” in an effort to find savings.

Speaking to broadcasters, Mr Kwarteng said that despite the pressures on the public finances, the Government would maintain the state pension “triple lock” but refused to commit to uprating benefits in line with inflation.

He said: “It’s premature for me to come to a decision on that, but we are absolutely focused on making sure that the most vulnerable in our society are protected through what could be a challenge."

The People's Poll

GB News

The People's Poll

GB News

The People's Poll

GB News

The People's Poll

GB News

The People's Poll

GB News

The People's Poll

GB News