Don't Miss

Most Read

Trending on GB News

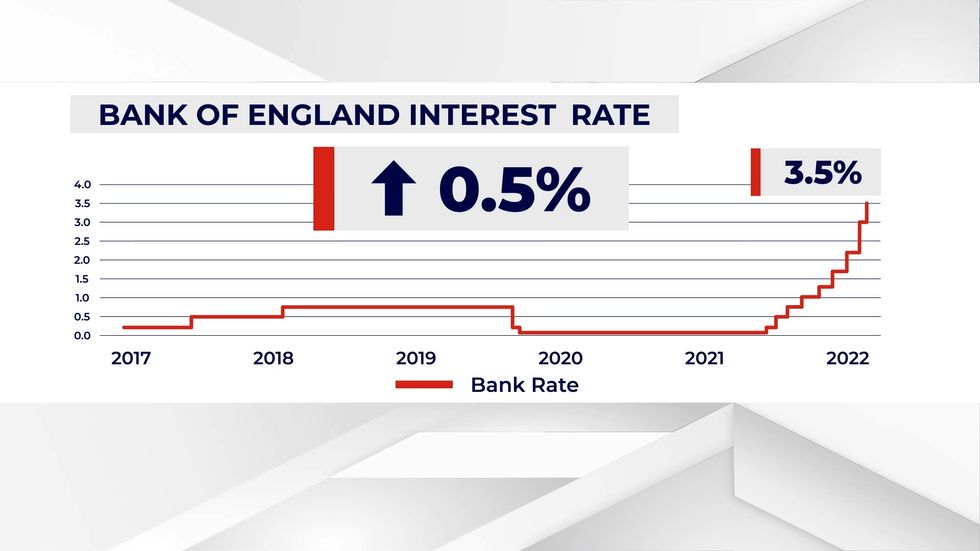

The Bank of England has signalled it could continue to increase interest rates over the coming months, as it raised its base rate to a fresh 14-year high.

Decision-makers said on Thursday that they are increasing interest rates from 3 per cent to 3.5 per cent, despite inflation easing last month.

It is a slowdown from the last rise in November when rates were increased by 0.75 percentage points, and in line with what economists had forecast.

Interest rates continue to rise, despite the UK facing a recession

GB News

Rates have been raised in every meeting since late last year as the Bank tries to get inflation under control.

The Monetary Policy Committee (MPC), which sets interest rates, said a “forceful” policy response was justified as the labour market remained tight across the month.

There are also signs that inflationary pressures could stick around for longer than thought, it said.

Most of the MPC’s nine members agreed that they would continue to vote for rate rises if the economy broadly continues to develop as the committee expected when it last met a month ago.

“The majority of the committee judged that, should the economy evolve broadly in line with the November Monetary Policy Report projections, further increases in Bank rate might be required for a sustainable return of inflation to target,” the Bank said.

Every 0.5 per cent increase adds £25 per month to a £100,000 mortgage

GB News

On Wednesday, the Office for National Statistics (ONS) revealed that inflation had reached 10.7 per cent – slightly lower than expectations and a reduction from the 41-year high seen in October.

The MPC is tasked with trying to get inflation under control, to 2 per cent if possible.

The Bank also said that the economy is now expected to do better in the final three months of 2022 than it had previously thought. Gross domestic product (GDP) is forecast to fall by 0.1 per cent in the fourth quarter, compared with the previous forecast of a 0.3 per cent drop.

The Bank of England is raising interest rates aggressively

Yui Mok

But two members of MPC voted for interest rates to remain unchanged at 3 per cent – going against the majority.

“The real economy remained weak, as a result of falling real incomes and tighter financial controls,” they argued.

“There were increasing signs that the downturn was starting to affect the labour market. But the lags in the effects of monetary policy meant that sizeable impacts from past rate increases were still to come through.”

Therefore, the two – Swati Dhingra and Silvana Tenreyro – said rates as they stand now should be “more than sufficient to bring inflation back to target”.

Another member – Catherine Mann – argued at the meeting for a 0.75 percentage point rise, to 3.75 per cent.

She said that, while inflation is easing, she saw evidence that rising prices and wages will keep putting pressure on inflation.

It comes as research From NimbleFinsfound those with a 75 per cent loan to value mortgage are being charged 3.9 times more on a fixed rate mortgage than they were 12 months ago.

This compares to those with a 95 per cent LTV being charged 2.3 times more - meaning homeowners with more equity in their properties are actually being punished by lenders.

It's a similar picture for variable mortgages, with rates 2.3 times higher for 75 per cent LTV compared to 1.2 times higher for a 95 per cent LTV mortgage. And the average interest rate for a 90 per cent LTV (4.12 per cent) was actually higher than the rate on a riskier 95per cent LTV (4.0 per cent) for 2-year variable loans.

Erin Yurday, co-founder and CEO of NimbleFins said: "Lenders used to charge quite a bit less for loans with lower loan to value ratios - up to 2.5 per cent less in 2021 - because it's seen as less risky.

"Basically if a homeowner were to default on their payments and the lender repossessed the home, it would need to recoup a smaller percentage of the house value to repay the debt.

"Charging lower interest to people who own more of their home also incentivises borrowers to repay their mortgages quicker.

"While the current mortgage rates are painful for all borrowers, it's not fair that hardworking Britons who are prudent with their money and look to the future are being penalised in this way.

"I was also surprised to see that people with a 90 per cent LTV are actually now being charged more than those with a 95 per cent LTV on variable mortgages.

"It doesn't seem right that those who may have worked hard to scrimp and save to get more equity in their home are being hit like this."