Don't Miss

Most Read

Trending on GB News

You might think the House of Commons Library sounds a dry old place where MPs while away the hours, thumbing through obscure texts.

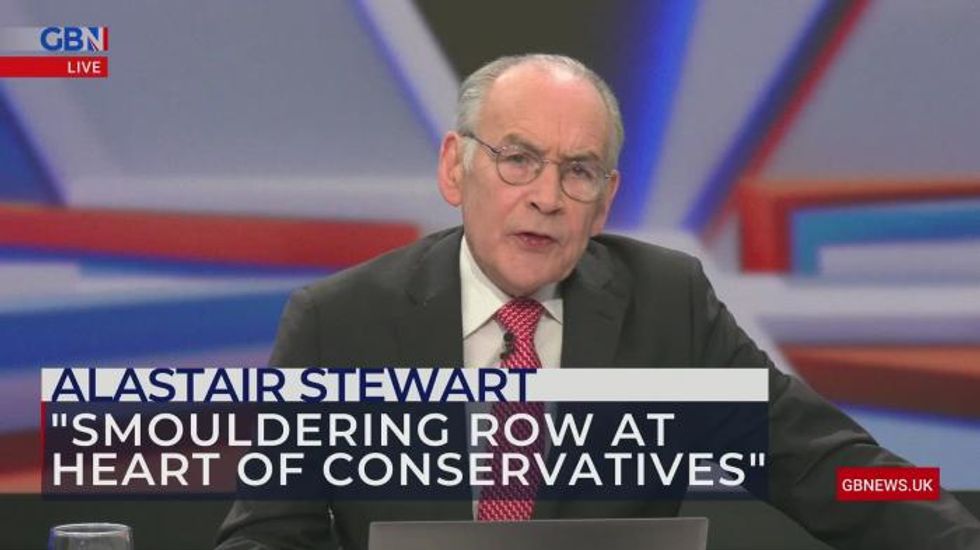

It's not. It is a brilliant source of information and has just emptied a can of kerosene all over a smouldering row at the heart of the Conservative Party.

It has published a paper that shows more than 1.2 million people will start paying the higher rate of tax of 40p in the pound.

It results from Chancellor Rishi Sunak’s decision in his March Budget last year to freeze the personal tax allowance and higher rate tax threshold until 2026.

Put simply the allowance is the amount you can earn before paying any tax - around £12,500 - and the threshold is the amount at which you start paying a higher rate: in March 2021 it was £50,270 and that is where it will stay until 2026.

By way of background, in my view two of the most significant Tory Budgets were Nigel Lawson’s in 1988 when he cut both the standard and higher rates of income tax, urging folk to work hard, earn more and keep more.

And the 2010 Budget, when George Osborne sharply raised the amount people could earn before paying any tax - he also pledged to keep doing it.

1988 was pure Thatcherism; 2010 was the era of the Tory-LibDem coalition.

But both were grounded in that central belief that Tory Governments should tax as little as possible and urge folk to work and earn as much as possible.

Johnson and Sunak have managed to annoy swathes of MPs on their own side.

When Brexit Minister Lord Frost resigned from the Cabinet last month he mentioned high taxation as one of his major concerns.

The 'rates' of tax haven’t risen but freezing the allowances has a similar effect, without the vicious headlines.

That’s why Jake Berry, a former Minister and Chair of the Northern Research Group pf Tory MPs, says it is little more than a stealth tax.

Another Tory MP, Craig Mackinlay, said it was “not too late” for the Chancellor to change his mind.

The Chancellor batted that away saying:

“It's always easy to duck difficult decisions but I don't think that's the responsible thing to do.”

But there was also a warning from Tory MP Andrew Bridgen who not only said the Chancellor would come under 'increasing pressure' to scrap the NICs rise but also suggested the Tories could suffer at the local election in May if the Government does not act.

It gets worse if you’re a low tax-low spend Tory because the freeze in tax allowances are but the brother and sister of the rise in National Insurance payments which kick in in April this year.

That was justified as a means of raising desperately needed money for solving the crisis in social care - once and for all’.

But it won’t.

The bulk will initially go to the NHS, as Number Ten explained:.

“All of us have been affected by the backlog in our NHS, this money, this £13billion that the levy will raise will in the first instance go towards tackling that backlog”.

And social care?

“In the longer term”, Number Ten explained “it will also tackle another fundamental issue that has been left aside for too long which is the unfairness in our current social care system”.

So, as Jake Berry said of the threshold move, you might argue the rise in National Insurance had something stealthy about it, too.

Outside of Parliament, these twin measures - on top of rising inflation - have few friends, either.

The Institute for Fiscal Studies said people faced a squeeze this year that 'could well be worse than the financial crisis'.

And Torsten Bell of the Resolution Foundation suggested the tax allowance freeze at the starting point would “mean an additional 1.5 million people on low pay will be dragged into paying income tax”.

Labour are lapping it up with Shadow Chief Secretary to the Treasury Pat McFadden MP saying: “The Tories' national insurance rise along with other tax hikes is leaving working people with the biggest tax burden in 70 years”.

Finally, there are those who might seek to succeed the PM.

It is reported that in addition to Jacob Rees-Mogg, Liz Truss, the Foreign Secretary also has her doubts about these impositions.

No resignation, like Lord Frost, and perhaps a little more circumspect than Jacob Rees-Mogg.

The fact that she may face the author of these plans, Chancellor Sunak, in any post Boris Johnson battle to be Boss, is also worth noting.

Finally, difficult decisions need strong justification.

If these were debt and deficit cutting measures they may find more friends on the Tory benches, painful though they’d still be.

They aren’t, so they won’t.

That they run counter to the Tory’s 2019 Manifesto is but water under the bridge these days - but it remains a fact.

The real gamble seems to me that it nibbles away at that central Tory mantra of low tax-low spend - a vessel of clear blue water if ever there was.

When Pat McFadden - no wild Corbynite but an experienced and wise Opposition player - can say the Tories are imposing “the biggest tax burden in 70 years” they shouldn’t need to go to the House of Commons library to see they have a profound problem.